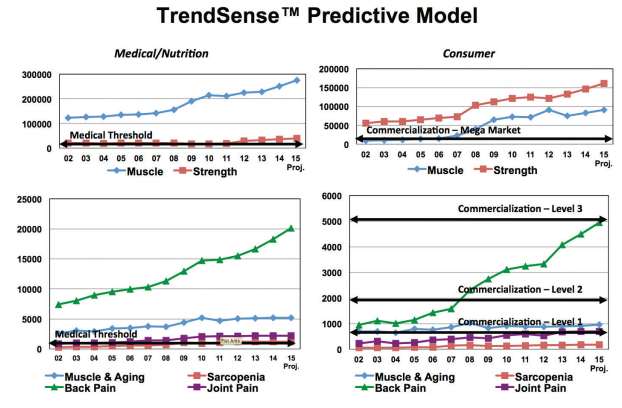

Our TrendSense™ Predictive Model . . .

Perfect Timing is Everything

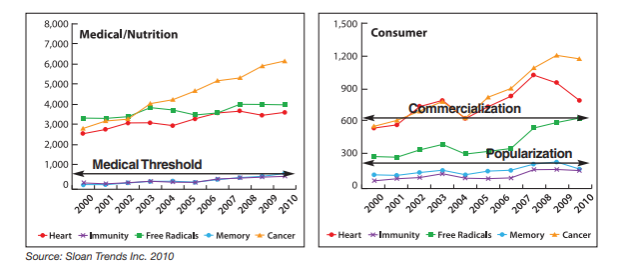

TrendSense™ is a 24-year-old- trend tracking system – which helps us identify and quantify health/nutrition trends, markets, issues, conditions, ingredients and terminology. It is designed to predict each trend’s/term’s sustainability, current lifecycle stage, and its optimal timing for mainstream consumer acceptance, if ever. It is a tool for identifying emerging opportunities, those that have lost their luster, fads vs. trends, and those that are giving way to other terms, e.g., phytochemicals historically morphing into bioactives.

Model Development

As part of the model development, the following parameters were considered: supplement, food, and pharmaceutical sales; health and natural food store sales; nutrition/pharmaceutical direct marketing and other alternative channel successes; new product activity; consumption data; regulatory activity/impact; consumer trends, behaviors and attitudes; professional, trade and media activity; and other critical market indicators. Threshold values were determined which triggered each phase of the term’s product lifecycle … Emerging, Popularization and Commercialization.

TrendSense™ is based on a system designed to monitor global medical, scientific, and technical electronic databases as well as consumer, general global and U.S. market activity; including media, trade, legal regulatory, sales, NGO activity, and other various streams of relevant information critical to market decisions in the food, health and pharma arena. Extraordinarily large and comprehensive databases are outsourced by Sloan Trends to research-specific electronic data supporters.

TrendSense™ also can help to determine:

- market potential for truly new concepts

- future weight of scientific evidence

- high potential, up-and-coming ingredients

- market synergies with other ingredients, such as maximizing bioavailability

- most marketable health linkages for an ingredient or condition

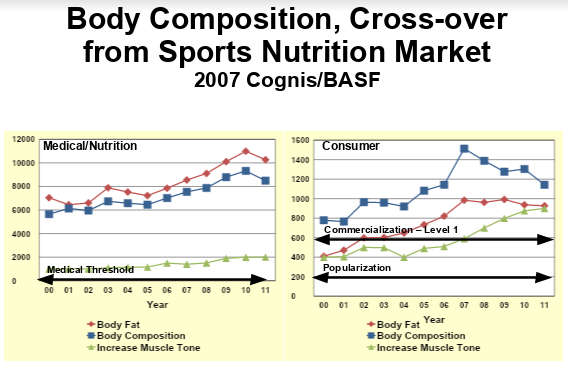

- crossover opportunities from other market sectors, such as sports nutrition

- impact of negative publicity on marketability

- second-generation opportunities for major health markets or ingredients.

We Can Tell You When

“In 2007, we would have told you that protein as well as muscle/body composition would be hot markets and in 2015, that stress, anxiety, cognition and some brain health linkages would soon skyrocket to mega market status.” We told our clients, e.g., Panera Bread, that the low carb trend would be a relatively short-term fad and unsolicited informed the world’s largest marketer of choline in 2016 that it was a major overlooked nutritional opportunity.

Some Classic Historic Examples, TrendSense™ Predictions:

Appropriate Magnitude & Timing, a Fad vs. Sustainable Trend:

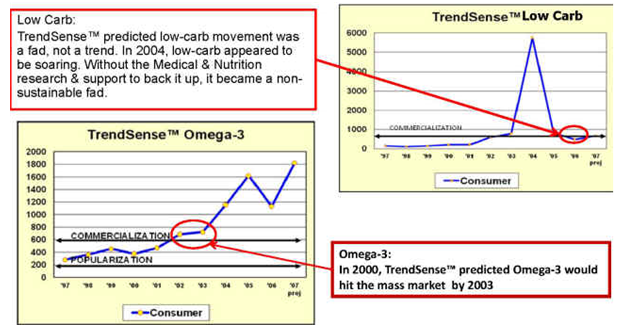

in 2004, TrendSense™ predicted that the low carb movement was a fad not a trend and we advised Panera Bread and others. In 2000, we would have told you that omega-3s would be a mass market opportunity by 2003.

Optimal Timing: New & Upcoming Ingredients

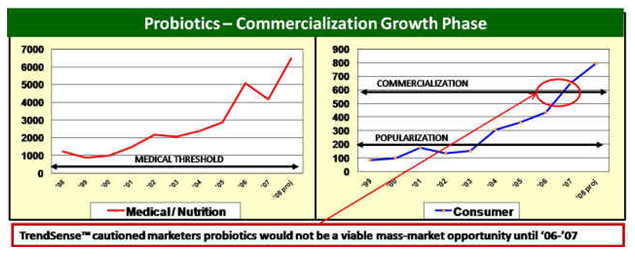

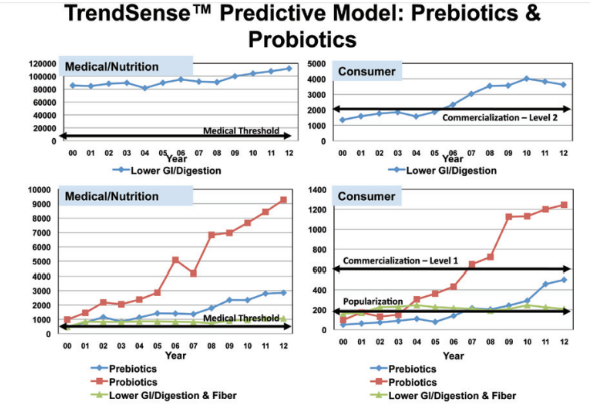

TrendSense™ predicted the timing for Dannon and other clients for the successful launch of probiotics to be a mass market opportunity in 2016.

Sorting through New Health Linkages, Timing & Priorities:

In 2008, TrendSense™ advised that mental/brain were about to become mass market opportunities for omega 3, in addition to cardio/heart health and that cholesterol, arthritis/inflammation were up-and-coming.

Identifying New Markets Positionings:

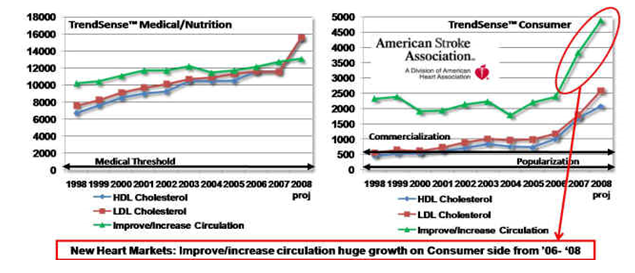

In 2006, TrendSense™ identified circulation as a fast-emerging market and ingredients positioning, just as health authorities were beginning to address the increasing incidence of stroke.

Giving Way to More Specific Sources/Terms

In 2010, TrendSense™ confirmed that the antioxidant market was maturing and that consumers had begun to look for more specific antioxidant sources and products that better aligned consumers with the individual health benefits they associate with antioxidants.

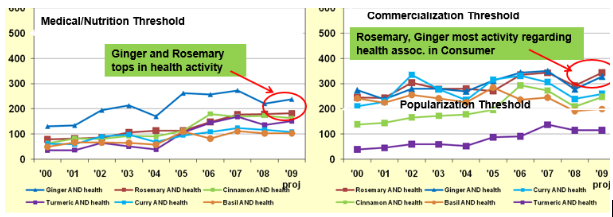

Medicinal Properties of Spices:

In 2009, TrendSense™ identified ginger and rosemary (antioxidants) as the lead spices with health/bioactive activity and identified/solidified spices as being an up-and-coming sustainable market trend.

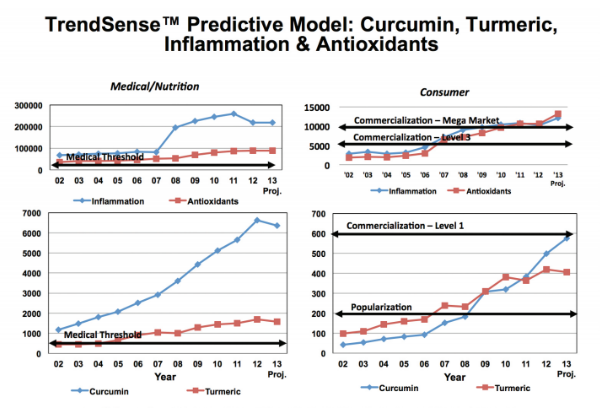

Curcumin/Turmeric:

In 2013, TrendSense reported this spice duo had reached mass market status, making the timing optimal for launch into mainstream channels vs. simply specialty/health food markets.

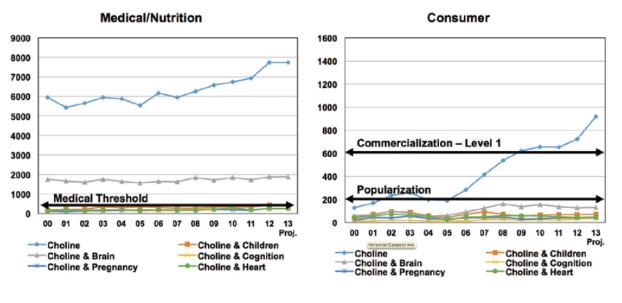

Choline:

In 2013, we reported to the largest manufacturers of dietary choline, that choline was a missed opportunity and had already reached mass market marketability.

Mobility

In 2015, we reported to our clients that mobility issues for young and old were a very large missed opportunity. Maintaining the ability to continue with my normal activities with age is now among the top health concerns globally, #2 in the U.S., per HealthFocus, 2019.

Identifying Opportunities in Large Traditional Medical Markets:

In 2011, TrendSense™ pointed to the rising interest/opportunity associated with stroke prevention, which coincided with the American Heart Association and National Institute of Health undertaking media activity to raise awareness of the rising incidence of stroke under age 65.

Protein:

In 2000, we would have told you that protein was associated with positive body composition, and in 2003 that consumers would look to protein for weight and fat management; in 2007 for muscle tone.

Do you want to get in touch?

Learn more about how Sloan Trends can help build Successful Sustainable Business-Building Ideas, Strategies and Solutions; Identifying Emerging Opportunities and Issues; and Helping to Ensure Leading-edge Scientific and Regulatory Programs for U.S. and Global Food, Dietary Supplement, Pharma, Ingredient, Commodity & Foodservice Industries.